Top Guidelines Of Kam Financial & Realty, Inc.

Top Guidelines Of Kam Financial & Realty, Inc.

Blog Article

9 Easy Facts About Kam Financial & Realty, Inc. Described

Table of ContentsAbout Kam Financial & Realty, Inc.The 7-Minute Rule for Kam Financial & Realty, Inc.The Only Guide to Kam Financial & Realty, Inc.Things about Kam Financial & Realty, Inc.Fascination About Kam Financial & Realty, Inc.Some Known Incorrect Statements About Kam Financial & Realty, Inc.

We may obtain a cost if you click a lender or send a type on our web site. This charge in no method impacts the info or recommendations we supply. We preserve editorial independence to guarantee that the recommendations and understandings we give are unbiased and objective. The lenders whose rates and various other terms show up on this chart are ICBs marketing companions they supply their rate information to our information partner RateUpdatecom Unless adjusted by the customer marketers are sorted by APR cheapest to highest possible For any type of advertising companions that do not provide their rate they are provided in advertisement display screen systems at the bottom of the graph Marketing partners might not pay to enhance the regularity top priority or importance of their display The rate of interest annual percent rates and various other terms advertised below are quotes provided by those marketing partners based upon the information you got in above and do not bind any kind of lender Month-to-month repayment quantities stated do not consist of amounts for taxes and insurance premiums The real payment responsibility will certainly be higher if tax obligations and insurance are consisted of Although our information partner RateUpdatecom gathers the information from the monetary establishments themselves the accuracy of the information can not be assured Rates might transform without notice and can alter intraday Several of the info had in the rate tables including yet not restricted to special advertising and marketing notes is provided directly by the loan providers Please validate the rates and offers before getting a funding with the banks themselves No price is binding until locked by a loan provider.

Kam Financial & Realty, Inc. Can Be Fun For Everyone

The amount of equity you can access with a reverse home mortgage is figured out by the age of the youngest consumer, current interest rates, and the value of the home in question. Please note that you may need to allot additional funds from the car loan proceeds to pay for taxes and insurance.

Rates of interest may vary and the mentioned price may change or otherwise be offered at the time of funding commitment. * The funds available to the consumer might be restricted for the initial one year after funding closing, due to HECM reverse home mortgage needs ((https://pinshape.com/users/6211647-kamfnnclr1ty#prints-tab-open). On top of that, the customer might need to allot additional funds from the financing proceeds to spend for tax obligations and insurance

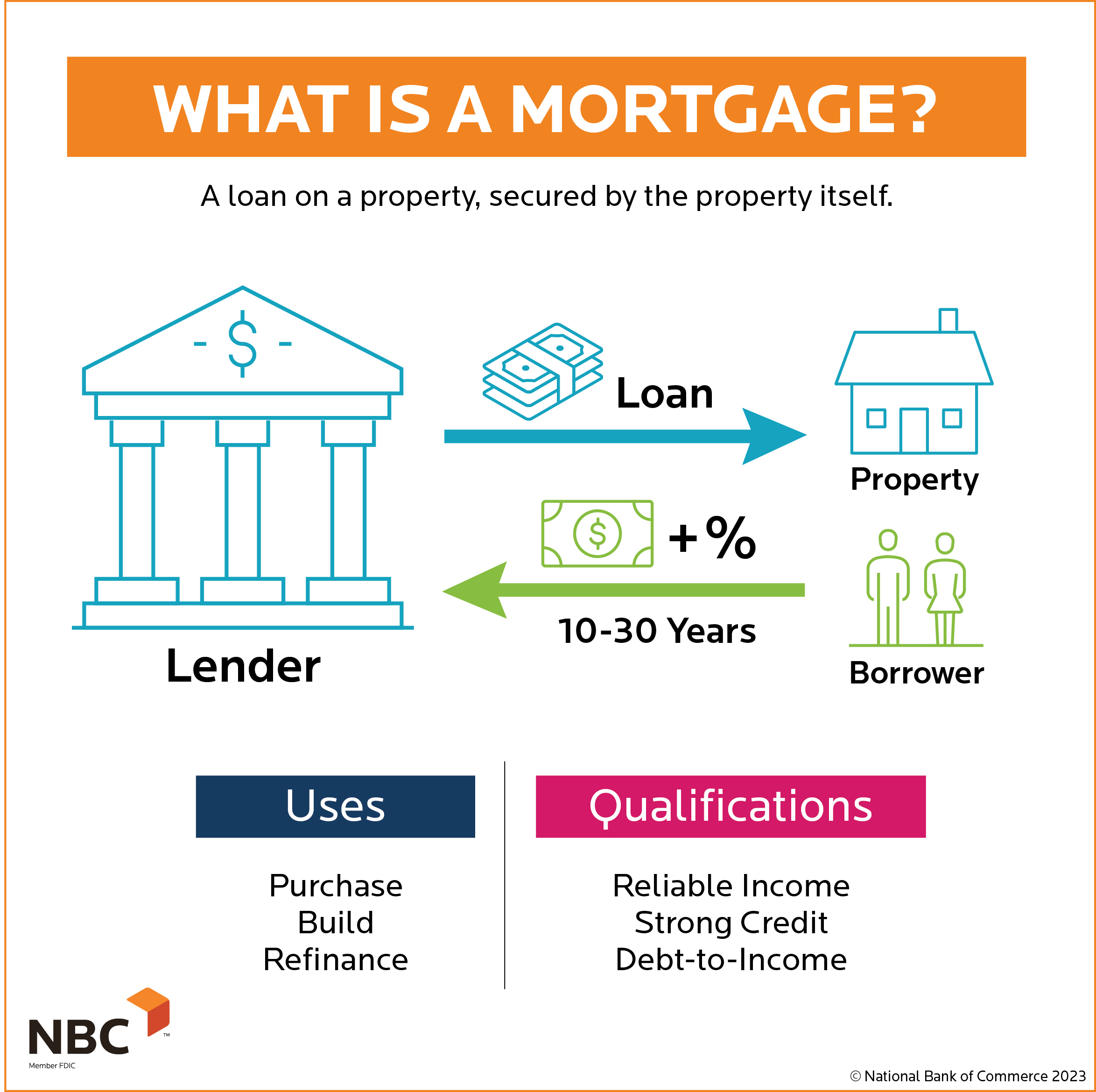

A home loan is basically a financial contract like this that permits a borrower to buy a building by receiving funds from a loan provider, such as a financial institution or banks. In return, the loan provider positions a realty lien on the home as protection for the lending. The home loan deal commonly involves two main files: a promissory note and an action of trust fund.

The Facts About Kam Financial & Realty, Inc. Revealed

A lien is a legal case or interest that a lender has on a consumer's home as safety and security for a debt. In the context of a home mortgage, the lien produced by the deed of trust fund enables the lender to acquire the building and offer it if the borrower defaults on the loan.

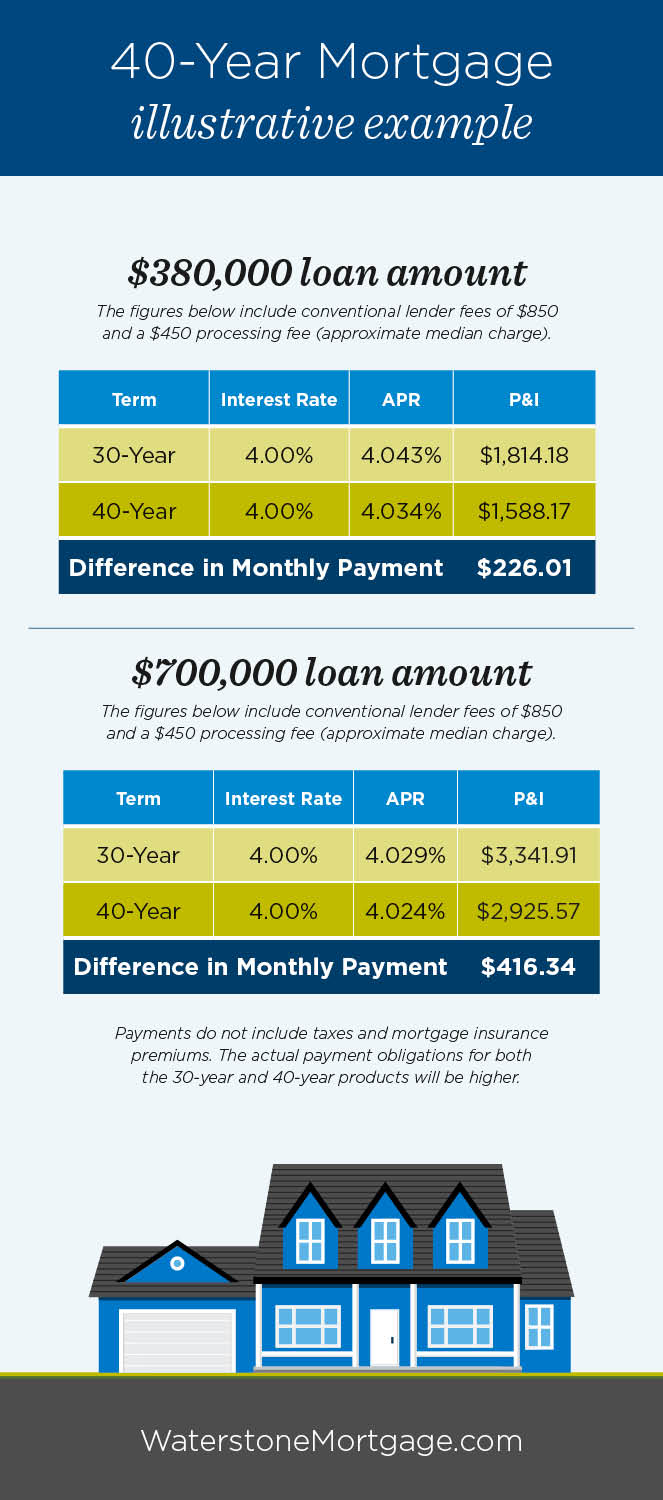

Listed below, we will consider several of the typical types of home loans. These mortgages include a predetermined rates of interest and regular monthly payment quantity, offering security and predictability for the borrower. John decides to purchase a residence that sets you back $300,000 (mortgage lenders california). He protects a 30-year fixed-rate home mortgage with a 4% rates of interest.

Kam Financial & Realty, Inc. - An Overview

This means that for the entire 30 years, John will make the same monthly payment, which offers him predictability and security in his economic preparation. These home mortgages begin with a fixed rate of interest and payment amount for an initial period, after which the rates of interest and settlements may be regularly changed based on market conditions.

The Best Guide To Kam Financial & Realty, Inc.

These home loans have a set rates of interest and payment amount for the car loan's period but need the consumer to pay back the financing balance after a specific duration, as identified by the lending institution. mortgage broker california. As an example, Tom has an interest in acquiring a $200,000 home. (https://www.startus.cc/company/kam-financial-realty-inc). He goes with a 7-year balloon home loan with a 3.75% fixed rates of interest

For the whole 7-year term, Tom's regular monthly payments will certainly be based upon this set rate of interest. After 7 years, the staying lending balance will certainly end up being due. Then, Tom must either pay off the superior equilibrium in a lump amount, re-finance the funding, or offer the residential or commercial property to cover the balloon payment.

Incorrectly declaring to survive on a residential or commercial property that will be made use of as an investment residential or commercial property in order to secure a reduced rates of interest. Evaluation fraud entails intentionally overvaluing or underestimating a home to either obtain even more money or safeguard a reduced price on a seized property. Incorrectly claiming self-employment or a raised position within a firm to misrepresent revenue for mortgage objectives.

Our Kam Financial & Realty, Inc. Statements

Report this page